Everyone needs a place to call home, even nomads. As a person on the road you must have a home state to obtain a driver’s license, vote, and acquire insurance. However, your nomadic flexibility allows you to choose which state benefits you the most. Many budding nomads focus mainly on potential income tax savings, while unfortunately ignoring the insurance implications of their choice. However, evaluating insurance options by state could significantly improve your coverage options and even lead to annual savings in the thousands of dollars. The research can be little tedious, but the benefits are well worth the time spent.

Insurance is regulated at the state level, leading to different rules and regulations from state to state. To add complexity to the situation, costs and coverage details can also vary by county within a given state.

If you’ll be covered by an employer sponsored health plan, great. You just need to understand the details of that plan to decide how to optimize your state of residence decision.

For the rest of us, medical insurance will be one of our top expenses, and our options are driven largely by our place of residence. Spending time to learn the details of what’s available in the states you’re considering, and if costs vary at the county level, can help you make the best residence decision.

Traditional Medicare costs are standardized across the US. Medicare Advantage Part C, Part D, & Medigap costs vary, however, sometime significantly. Here are the 2021 average monthly premiums for Medicare Advantage plans that include prescription drug coverage.

Looking at the table you’ll see you could save more than $600 a year just by residing in Florida as opposed to South Dakota.

If you’re covered by Medicare, you should understand how Medicare Advantage and basic Medicare + Supplemental coverage differ. Supplemental medical plans are “standardized” which means each plan covers the same broad offering of services. If you enroll in a Supplemental Plan you’re allowed to go to any provider that accepts Medicare, wherever they are. This gives enrollees fabulous flexibility as to how, when, and where to get medical services.

Medicare Advantage plans, on the other hand, typically have lower monthly premiums and include an expanding array of services, like dental or vision coverage. Most Medicare Advantage Plans are HMO or PPO plans, meaning you could be restricted as to where your insurance is accepted.

There are lots of details to research when deciding on Medicare coverage. Taking time to educate yourself will pay off in the long run.

For those of us not on Medicare or an employer sponsored plan, we need to look at the “individual” medical plans and how to minimize costs while maximizing plan value.

The first decision you need to make has nothing to do with costs. What type of medical plan do you want? There are all sorts of medical plans out there with various names, but they all fall into one these basic types:

You will need to determine which type of coverage works best for you. As full-time travelers, we need to have access to care regardless of where we are when the need arises. Thus, the only suitable medical plans for us were PPO or EPO plans.

The easiest way to figure out what each state offers is to search for ACA plans on Healthcare.gov. You can do this any time of year, not just during open enrollment. Answer a few questions and provide any zip code for the state you are researching. Hit enter. It’s that easy.

Your inquiry will return the provider networks and plans that state offers. At this point, don’t worry about individual plan specifics, such as Bronze/Silver/Gold, premiums, coverage, etc. Your goal at this step is to determine if there is an offering in your preferred state or states for the type of coverage you’re looking for.

For us, Texas and South Dakota were immediately a “no go” as they only offered HMO plans for 2020 on the marketplace. Ultimately, we determined that Blue Cross Blue Shield PPO or EPO plans were our best options. They have a huge nation-wide physician network that meets our needs perfectly. Once we knew that, we focused on learning more about the states that offered BCBS PPO/EPO plans. We compared the costs of similar plans across states and identified Florida as our preferred choice.

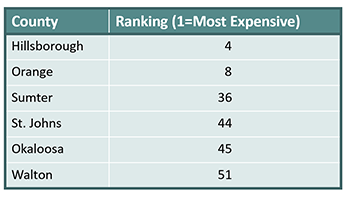

Now that you have your state identified, you need to get down to the county level. For states like Florida, a given plan’s premium can differ as much as $300 to $450 a month based on county of residence.

Go back to Healthcare.gov or the state’s insurance marketplace and search with a zip code from each county you’re interested in. Many travelers identify the counties where mail services are located as the counties they consider.

We created a simple model to rank the candidate Florida counties by monthly premiums, from highest to lowest. Below is an excerpt from that model.

Once we collected all this info, we switched gears and looked at the other major insurance we would need.

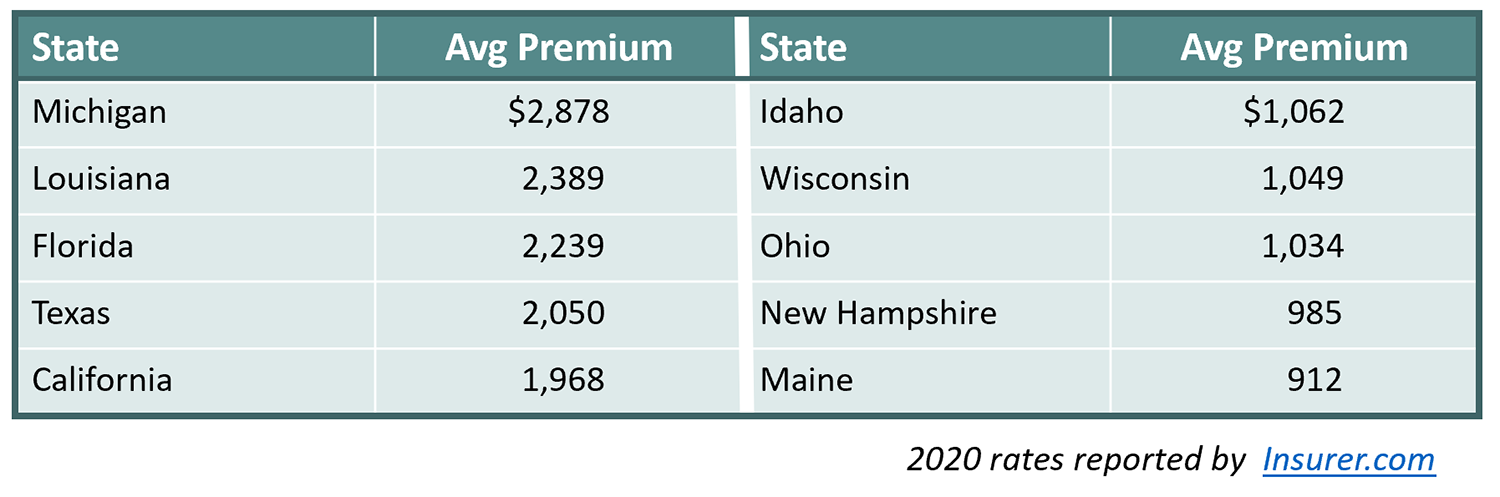

Car insurance is another required expense that you should consider. Average monthly premiums can vary greatly from state to state. Here are 2020’s most expensive and least expensive states for car insurance.

There’s more to these averages than meets the eye, however. Take Florida for example. Florida earns its ranking as the 3rd most expensive state due to its generally a higher number of higher-risk drivers: an older population, numerous universities & colleges, and a large number of uninsured drivers. Not all Florida counties have the same mix of higher-risk drivers, however, and premium costs vary greatly from one county to the next.

Below is ranking of some Florida counties from most to least expensive:

As you can see, Hillsborough County (which includes Tampa) and Orange County (home of Orlando) residents pay average or above average premiums, whereas residents of Okaloosa and Walton Counties pay well below average. We ultimately choose to reside in Okaloosa county, and our automotive insurance premiums are low. They’re lower than the average car coverage cost for Maine residents, and Maine is the the cheapest car insurance state in the country.

Being a full-time or even most-of-the-time traveler allows you the ultimate flexibility in selecting your state of residence. You can literally live just about anywhere, it’s your choice. Careful consideration of the insurance implications of that decision can potentially save you thousands of dollars each year. It can also ensure you have the best medical coverage for your needs. Spending less on insurance premiums means you’ll have more money to spend on the fun things, which is something we all want.

Leave a Reply